The COVID-19 virus has changed our world. It’s brought out the best and worst in people and exposed many of our shortcomings as a culture and a global society. We were clearly unprepared. Hospital emergency rooms and healthcare workers are overwhelmed. Apparently, we have not created a healthcare system that can consistently respond well to such a crisis. Schools, businesses, state and local governments have had to shut down and go virtual. There’s been a global economic and financial contraction reminiscent of the Great Depression. Many people are unable to work, and earn a living. Some are concerned about the long term viability of their businesses or their employer’s business; they’re justifiably concerned about their futures. Yet, in cities around the world, healthcare workers, police, firemen, grocery store employees, and anyone else who must serve the public despite the virus are being applauded and recognized for their service. Governments and charitable organizations are rallying, attempting to help those most in need.

Individually, we’ve all had to deal with social distancing, isolation, and the psychological effects of fear and uncertainty. Some of us have had to deal with actual COVID-19 infections, the resulting sickness, and even ultimate death among our family, friends, and colleagues. Reported domestic violence, suicide hotline activity, and alcohol consumption are all on the rise. And yet, there’s good news too. In practicing social distancing, people are demonstrating not only enlightened self-interest for their own health but also for the health of others. Families are spending time, sharing meals, doing homework, engaging in games and other activities together; doing things that previously they were too busy, over-scheduled, and over-committed to plan or engage in.

“Happiness and freedom begin with a clear understanding of one principle: some things are within our control and some things are not. It is only after you have faced up to this fundamental rule and learned to distinguish between what you can and can’t control that inner tranquility and outer effectiveness become possible.” – Epictetus, Greek Stoic Philosopher, 55-135 AD

Does anyone doubt that there will be a “new normal” when things settle down and we’re able, with some conditions, to leave our homes and go back to work? Most of us are not in a position to directly influence whether or not the country is better prepared for future pandemics, the economy can be restructured to grow again and eventually recover from this deep economic and financial crisis, or repair the many damages to the political and social fabric of our society. As the quote from Epictetus implies, we should focus on what we can control.

If history is any indication, we can’t count on the general population to make dramatic positive personal changes in the aftermath of the coronavirus. Instead, people will yearn for the way things were, the lifestyles they once had, and the comfortable, yet false, sense of security they once enjoyed. Many will revert back to habitual behavior, indulging in news, social media, idle conversation, and/or rumination about matters that they have no control over.

When people talk about the silver lining that has come out of this crisis, I hear a lot about how people are kinder, more considerate, more generous, and caring. People seem to suddenly feel genuinely grateful for good health, food, safe homes, family, friends, small comforts, and a civil society. Might we apply what we know about habits, routines, and human behavior to make gratitude an enduring and prominent part of the new normal?

“When we are challenged we do not rise to our expectations, we fall to our level of practice” – Archilochus, Greek Poet, 680-645 BC

In many ways, the coronavirus has been the ultimate stress test of our values and our intentions. Might we also remember what we’ve become acutely aware of during this unprecedented time? This crisis has revealed to many of us that our pre-coronavirus “goals” in life may not have reflected what matters most. If we are to survive and live happy, fulfilling, meaningful, and joyful lives, isn’t it imperative that we get our priorities straight and that we live with high intention?

“What many of us are discovering right now is that things we valued a few months ago don’t actually matter: our cars, the titles on our business cards, our privileged neighborhoods. Rather what’s coming to the forefront is a shift to figuring out what we find intrinsically rewarding…when a crisis hits, everything is put to the real test…The challenge then becomes wrapping our struggles into our values, because what we value only has meaning if it’s important when life is hard. To know if they have worth, your values need to help you move forward when you can barely crawl and the obstacles in your way seem insurmountable.” – Shane Parrish, Farnam Street blog

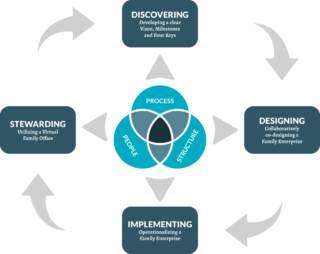

We named our process the Universal Framework because we’ve found, regardless of specific methods and circumstances, that all effective strategies and plans follow a similar pattern of discovering and illuminating what matters most, thinking about and designing actions to improve situations and circumstances, implementing and executing on plans and strategies, and, importantly, overseeing results, monitoring and adapting to new situations and circumstances (what we call stewardship). In our experience, where people often fall short despite their best intentions is being accountable for execution, ongoing monitoring, and adaptation. Thus, throughout this ongoing process, in addition to our roles as advisors, planners, and collaborators, we see ourselves as accountability partners with our clients and co-collaborators. We think it’s a win-win.

In the “new normal”, rigid, long-term planning and plans will be impractical and likely sub-optimal; too much will remain unknown and unknowable. It behooves us all to be flexible, agile, and adaptable in our thinking and actions. Despite the volatility, uncertainty, complexity, and ambiguity ahead, we have the opportunity to not only shift the way we think about wealth and our priorities but also to rebuild and reorganize our lives around our values; to walk our talk about money, wealth, and what truly matters to us individually, as families, and collectively as a civilized society. And make no mistake about this; what we decide and do will matter. We’re in this together.