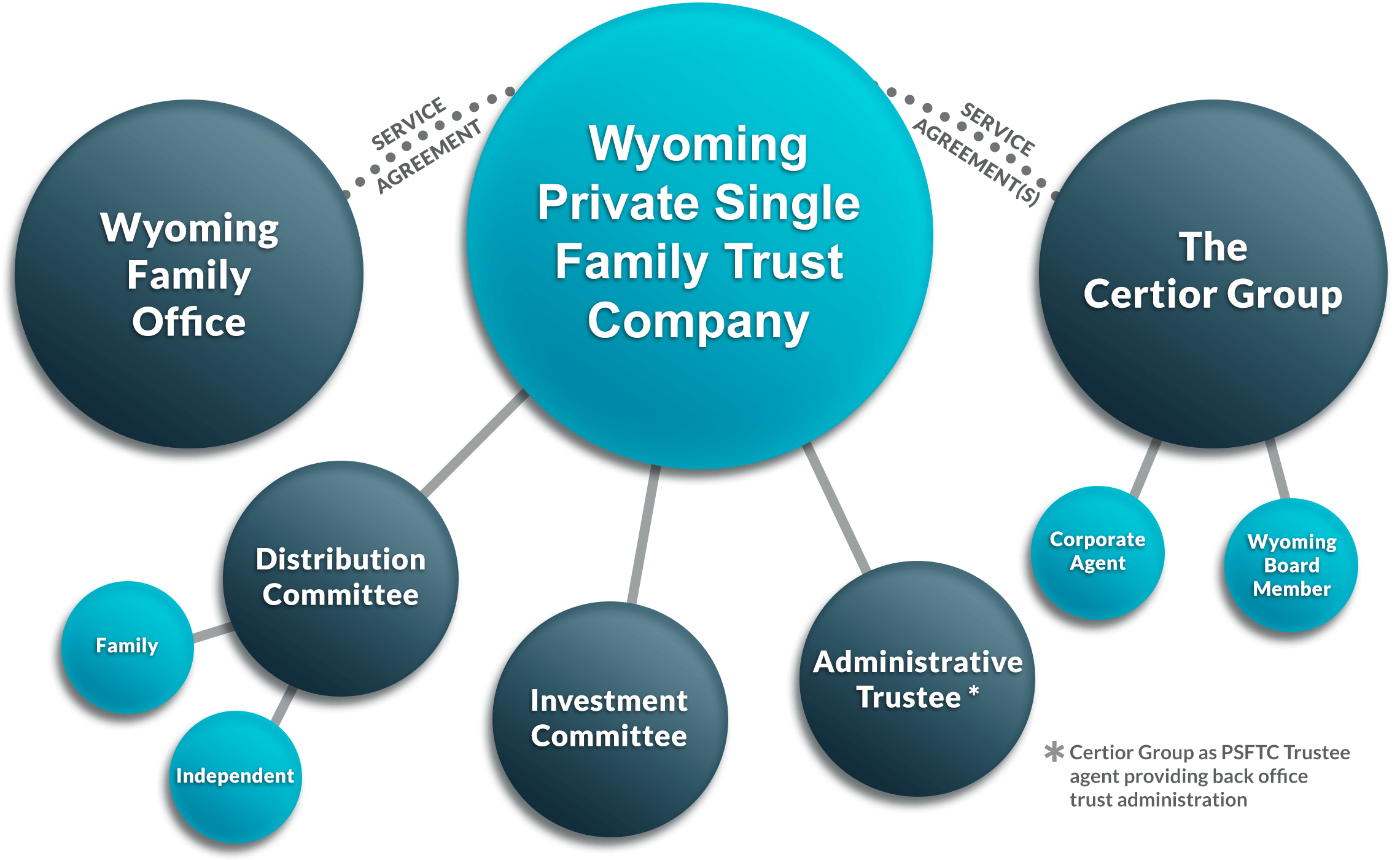

A PSFTC has a board of directors and officers (or Managers if established as an LLC) and committees that make certain decisions and recommendations. The directors are usually family members and selected trusted advisors that have legal, investment, tax, accounting, or other specialized expertise.

Typically, a PSFTC will operate with at least two committees: an Investment Committee and a Distribution Committee. The investment committee establishes an Investment Policy Statement and oversees the implementation of Investment Strategies. The distribution committee is responsible for approving Beneficiary Distributions and Overseeing the Distribution Process.

Typical Modern Private Single Family Trust Company

- Step 1:

- Form a Wyoming LLC or Corporation and obtain approval from the Wyoming Division of Banking to be a PSFTC

Though not required in Wyoming, it may be beneficial to obtain an office in Wyoming, one Wyoming Board Member and a Wyoming Corporate Agent. The Certior Group sits on the board and servers the role as a Corporate Agent, i.e. providing office space to the PSFTC, collecting mail and answering the phone.

- Step 2:

- Wyoming PSFTC leases services from Family Office in another state, assuming they have a Family Office

- Step 3:

- Trust administration can be done in Wyoming to benefit from Wyoming’s favorable trust laws by hiring The Certior Group as an agent for the PSFTC [or] certain administration functions can be done in another state (interstate administration allowed) by Family Office and its advisors. The latter may not garner the benefits of Wyoming trust and tax laws.

Regulated and Unregulated PSFTCs

A regulated PSFTC is called a Chartered Family Trust Company and is regulated by the Wyoming State Banking Commission. Requirements for a Wyoming regulated PSFTC include, in part:

- A minimum capital requirement of $500,000.

- A physical office in Wyoming.

- An annual compliance report.

- An examination by the Wyoming State Banking Commission at least once every three years.

In contrast, with an unregulated PSFTC, compliance and auditing requirements are established by the Directors of the PFTC, rather than the state. Also, an unregulated PSFTC typically falls under the SEC’s family office exemption from registration with the SEC.